Smart Tips About How To Improve Your Credit

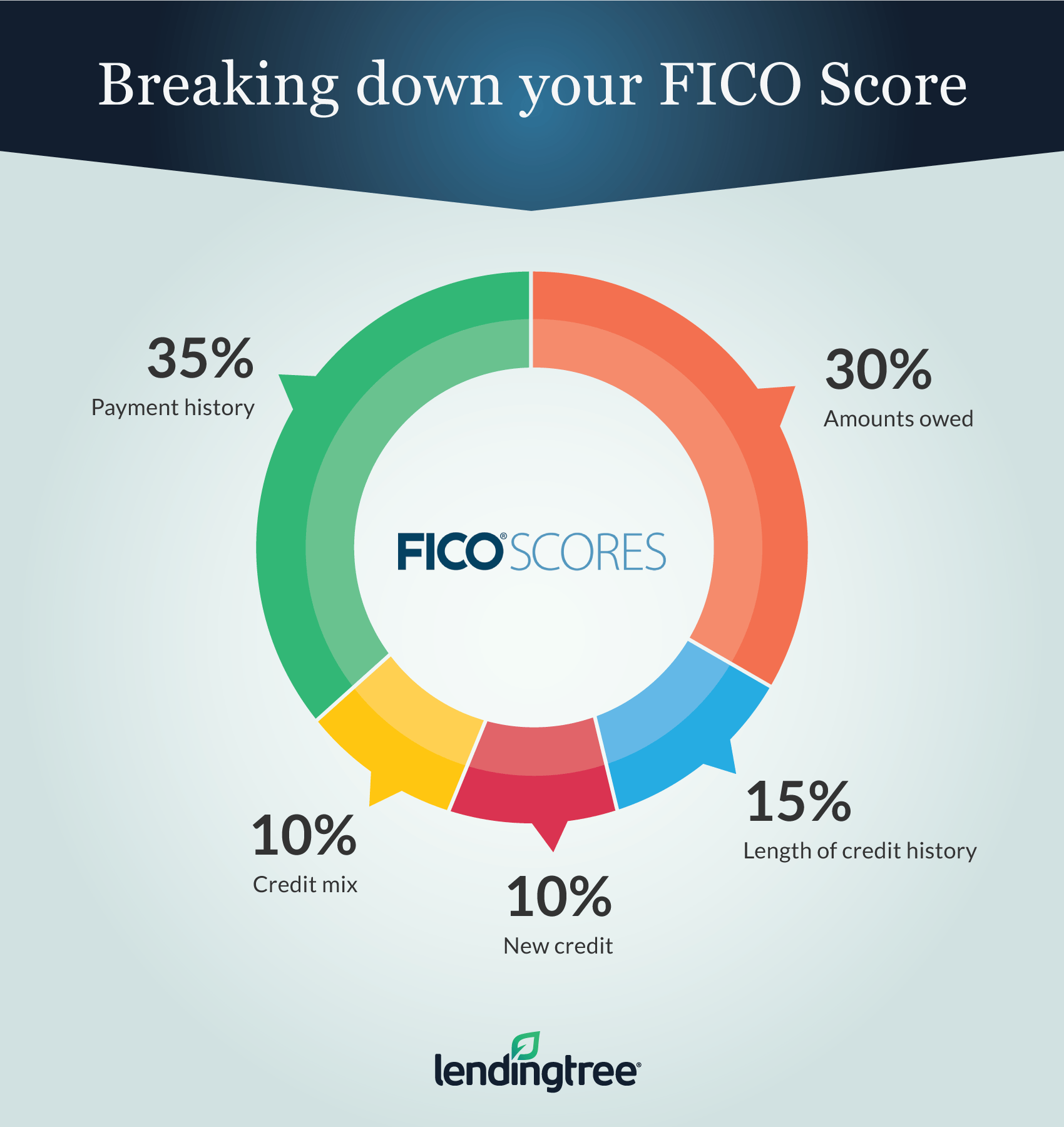

Start the process by learning how credit scores are calculated so.

How to improve your credit. Pinpoint what you need to improve 3. Ad find your next credit card with nerdwallet's impartial reviews. Find a card offer now.

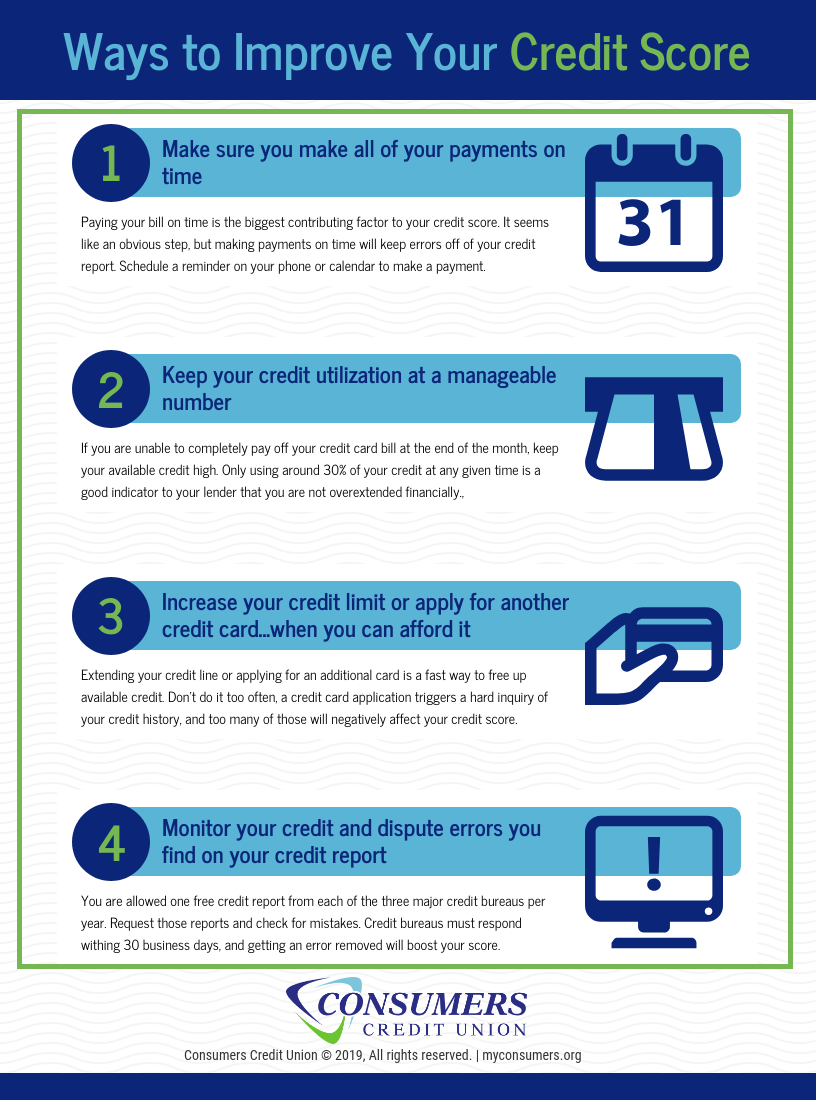

Also, hang tight if your. To avoid falling into this trap and going over the 30% threshold, always keep an eye on your balance, says beverly harzog, author of five books about credit and personal finance. Fix your late payments 4.

Ad responsible card use may help you build up fair or average credit. Ask for higher credit limits 3. How to raise credit score, how to improve credit immediately, how to rebuild credit, how to raise credit score 100 points, how to build credit quick, credit cards to improve credit, how to.

Here are some strategies to quickly improve your credit: Ad build positive payment history with self. Fastest ways to raise your credit score in 2022 1.

One of the major jobs of the three major credit bureaus (equifax, experian, transunion). Ad fast and easy access to your credit report. Therefore, the next important step to take to improve your.

A key factor determining your credit score is your credit utilisation ratio. Get started saving with special offers to help you meet your financial goals today. Take some of the stress out and get help managing debt.

To reduce your credit utilization ratio quickly and improve your score, use the debt avalanche or debt snowball method to pay down existing debt: How to build your credit, how to raise credit score 100. If you have a $1,000 credit card balance on a card with a $2,000 credit limit, your credit utilization ratio for that account is 50%.

Ad receive a credit builder loan for as low as $25/month, and watch your credit improve. Become an authorized user 4. Here are six tips that may help you improve your credit score.

Credit utilization is the next largest factor, making up 30% of your overall credit score. With nerdwallet, compare top credit cards, filtered by credit score, reward type and more. Find a card with features you want.

Fico scores range from 300 to 850, with scores between 800 and 850 deemed “exceptional” by lenders. Check the accuracy of your credit reports 2. The higher your credit score, the more access you have to the best deals on loans, credit cards, insurance premiums, and even apartment leases.