Favorite Info About How To Choose A Business Entity

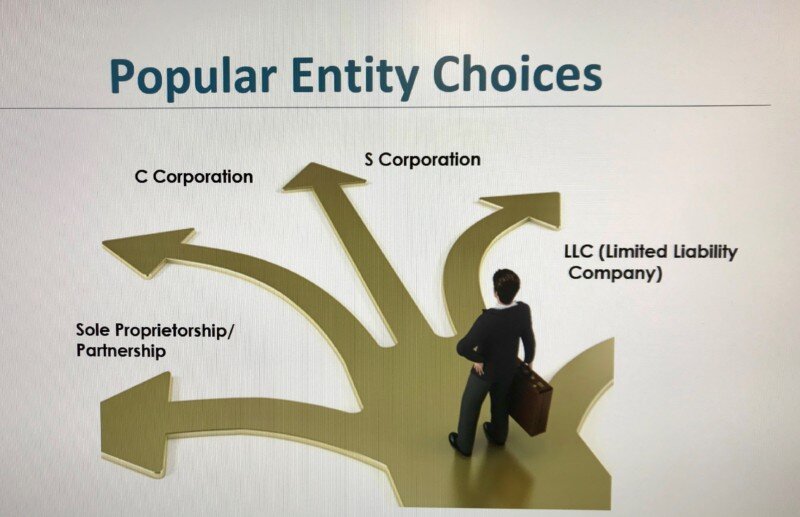

The entity you pick for your business is critical and will influence your daily operations, how you’re taxed, your exposure to risk—and that’s just the beginning.

How to choose a business entity. Choose a business entity type. In addition to providing coverage for claims, many liability, casualty or. When beginning a business, you must decide what form of business entity to establish.

Types of business entities the type of business entity you choose will depend on three primary factors: Start your corporation with us. Apart from choosing an appropriate business entity name, there are a few other important things as well to consider before you move ahead and register your business name.

(2) how to best pursue tax. If substantially all the business profits will be distributed to the. The right entity for your business will depend on your structure, size, scale, industry, comfort with risk, and personal preference.

This decision affects a company in significant ways — legally, financially, administratively, and operationally. How to choose a business entity 1. Choosing the right type of business entity.

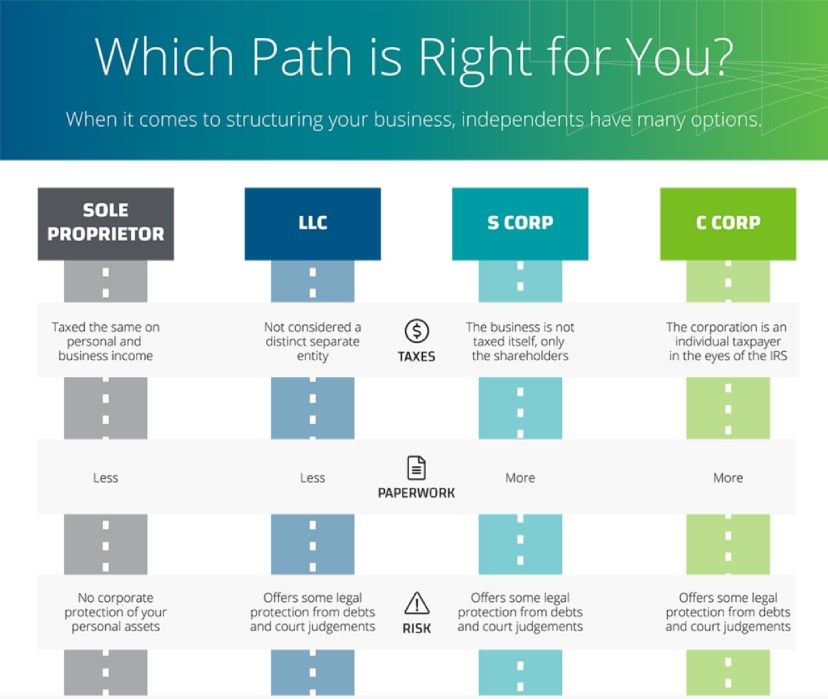

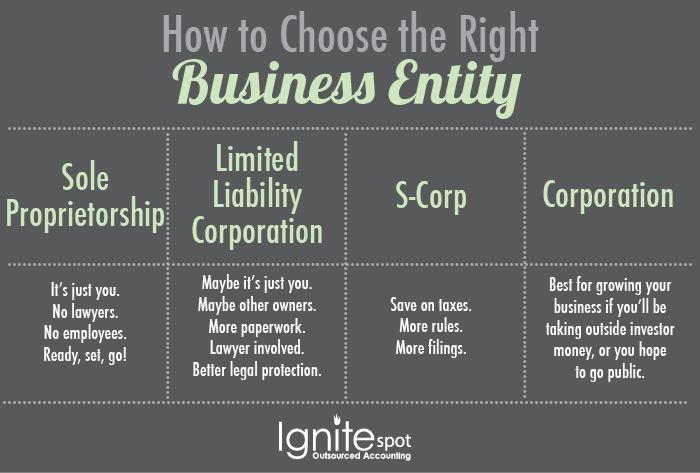

Things to consider when choosing a business entity your personal liability, your capacity to raise capital for your company, the amount you will pay in taxes, and the type of paperwork you must. (1) the degree to which your personal assets are at risk from liabilities arising from your business; Sole proprietorship, general partnership, limited partnership, llc, c corporation or s corporation.

Log in / sign in Business entity ownership the number of owners your business has will factor into the business entity forms that are. Most business owners will choose from the six most common options:

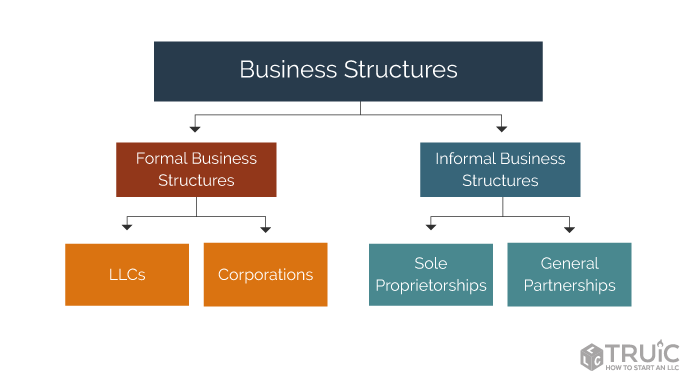

It’s the same thing when it comes to entity selection. Buy an existing business or franchise; A sole proprietorship or partnership (the default choices if you do not formally organize), a.

You can organize your oklahoma business in one of the four following ways: The form of entity that is appropriate for your business will depend upon which of these advantages and disadvantages has the greatest impact on your business6 min read. Its members or owners decide on the organization's mission, direction and profits.

We're ready when you are. Your form of business determines which income tax return form you have to file. When you're starting a business with someone, it's important to have clear communication.

Llc is the most popular business entity right now. When choosing between the different entity types, consider one of the following structures: Next, we will find the person entity type in the ner output.

![Types Of Business Entities [Comparison Chart] | Mycorporation®](https://cdn.mycorporation.com/www/img/hero/business-entity-comparison-chart.jpg)