Ideal Info About How To Build Your Credit After Bankruptcy

Paying off the full credit.

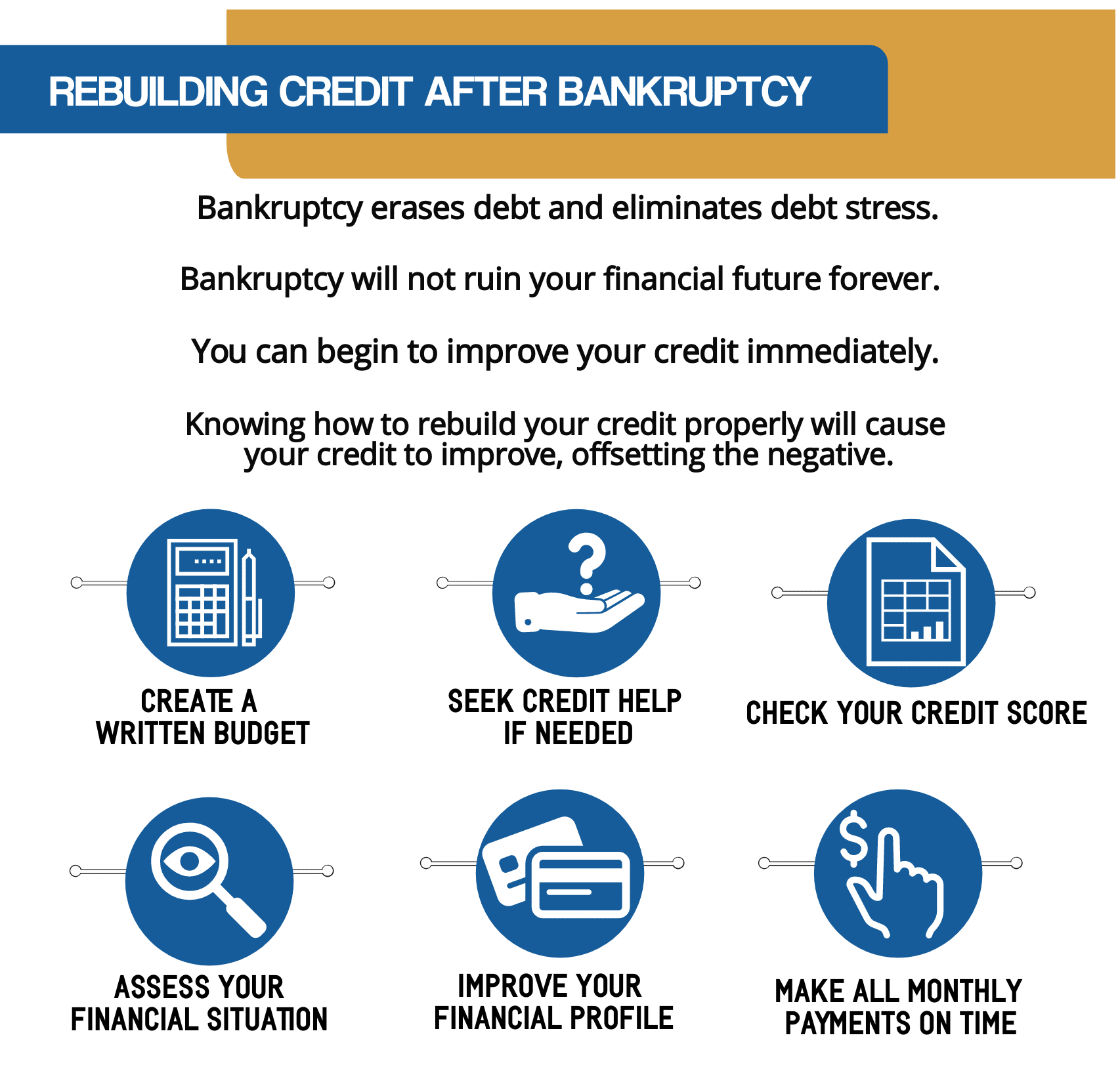

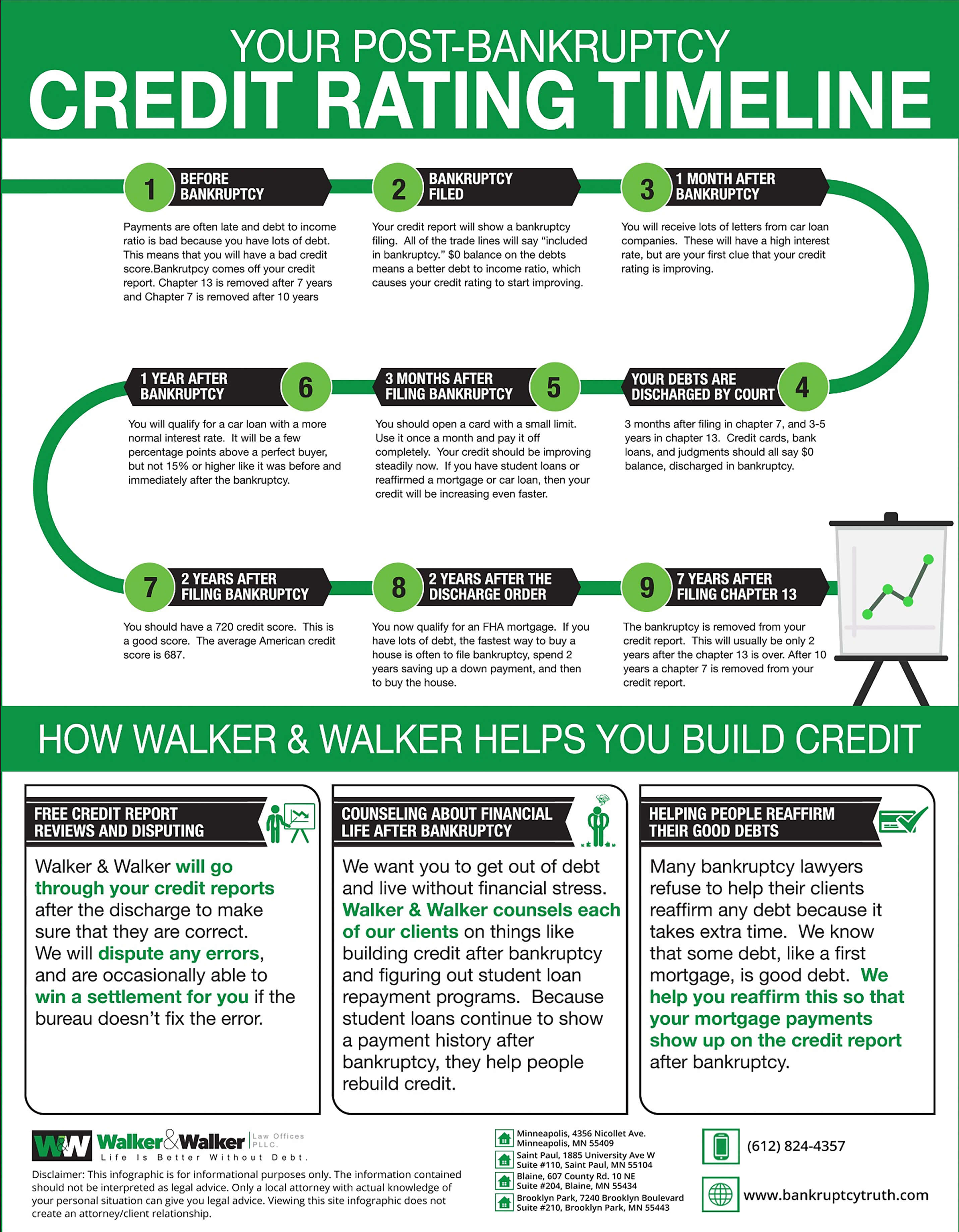

How to build your credit after bankruptcy. How to build credit after bankruptcy. Rebuilding your credit after filing for bankruptcy can seem daunting, but there are some steps you can take to help your credit. Car loans are the first type of loan you can get after bankruptcy.

In the meantime, you can start improving your credit right away by taking some proactive steps. Our certified debt specialists help you achieve financial freedom faster. You can build credit after bankruptcy by making wise financial decisions.

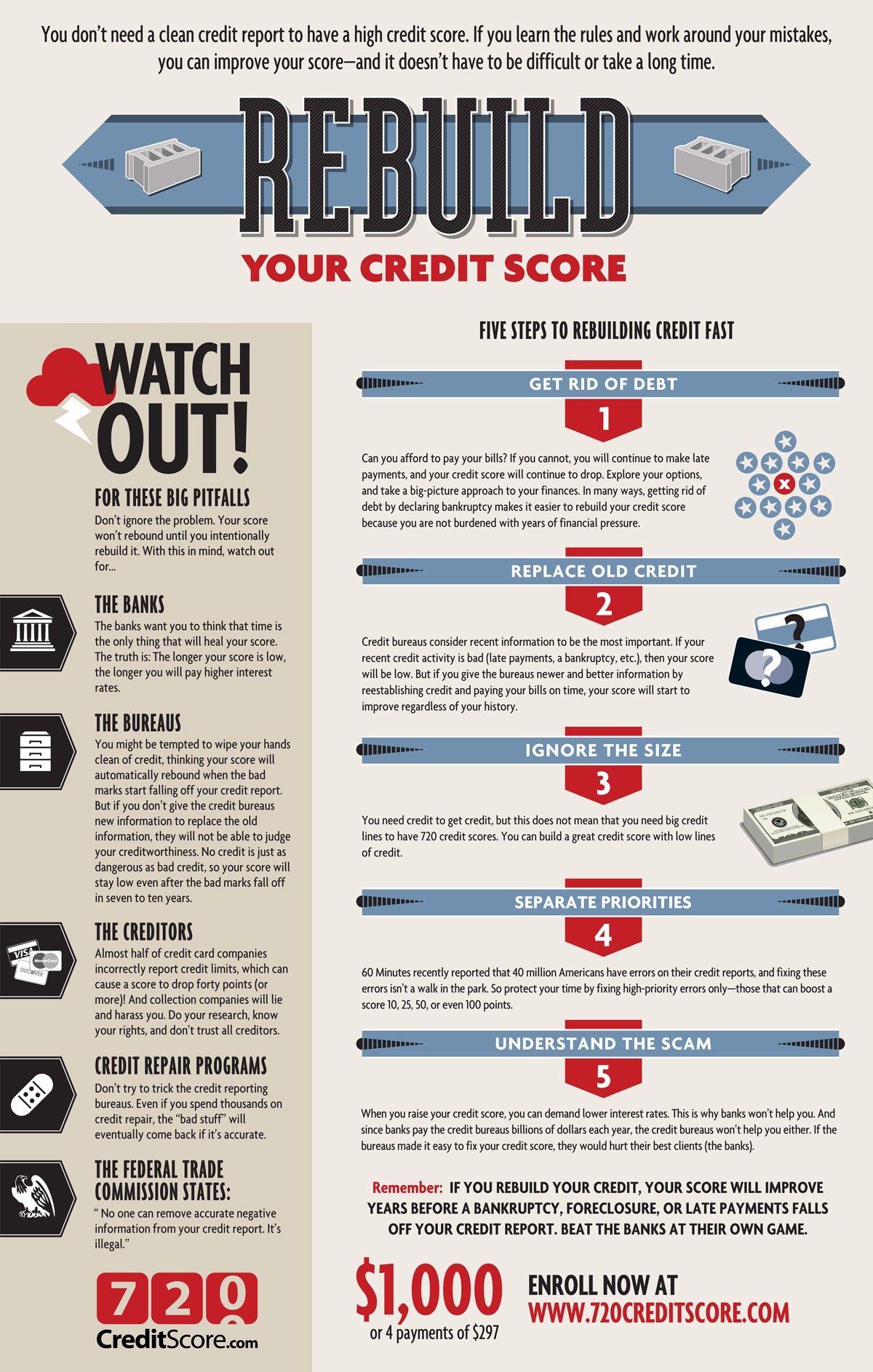

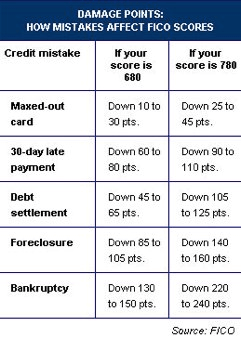

You need to wait 30 days after you receive the final discharge. In simple words, filing bankruptcy comes with a negative credit score that can impact your financial loan. Get collections and bad debts settled.

First, you must make sure there are no unpaid debts or items in collections that. How to build credit after bankruptcy review your credit report. Open a credit card or loan;.

Live within your means and use credit accounts sparingly. Ad one low monthly payment. Find a card with features you want.

This means most (or all) of your accounts will be at a zero balance, and creditors must stop calling you about. Like a secured credit card, it’s a secured method of building credit. Once you’ve completed your bankruptcy, here are the basic steps to building your credit:

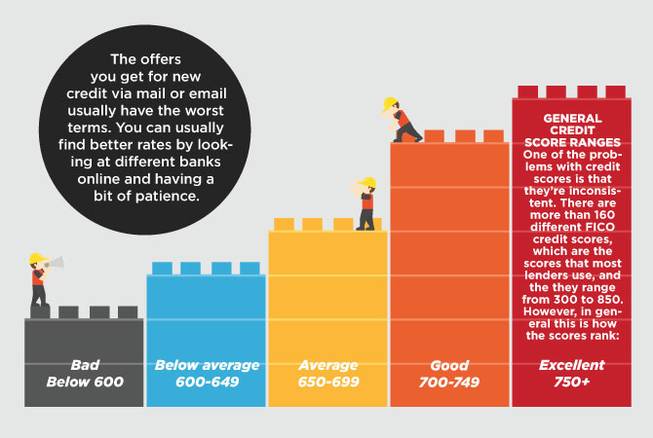

Practicing good financial habits is the key to. Ad responsible card use may help you build up fair or average credit. Ad you can increase your fico® score for free.

As you can see, a credit builder loan is a completely different way to begin rebuilding your credit after bankruptcy. Get more control over your financial life. New credit scores take effect immediately.

After bankruptcy, your credit can take a big dig. Find a card offer now. Apply for a small loan.

Check credit reports to ensure that there is no information that is inaccurate or remained on your credit report after filing for bankruptcy. Most people that file with walker & walker get dozens of envelopes with car loan offers in the mail within weeks of filing. It’s especially attractive if you’d rather not have a secured credit card.