Wonderful Info About How To Appeal Taxes

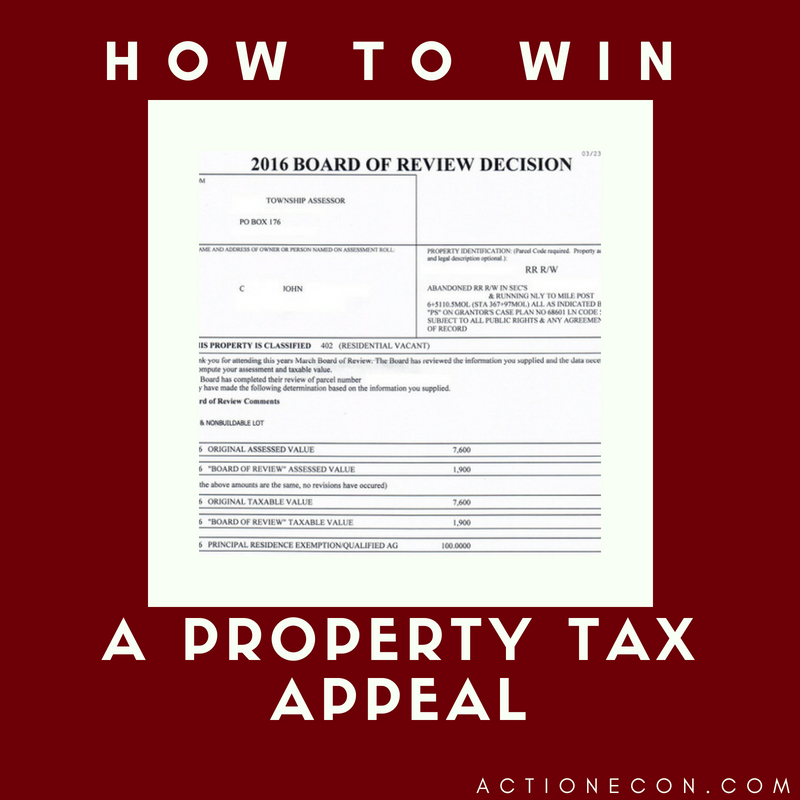

Make note of the appeal docket number you’re given, which you can use to track.

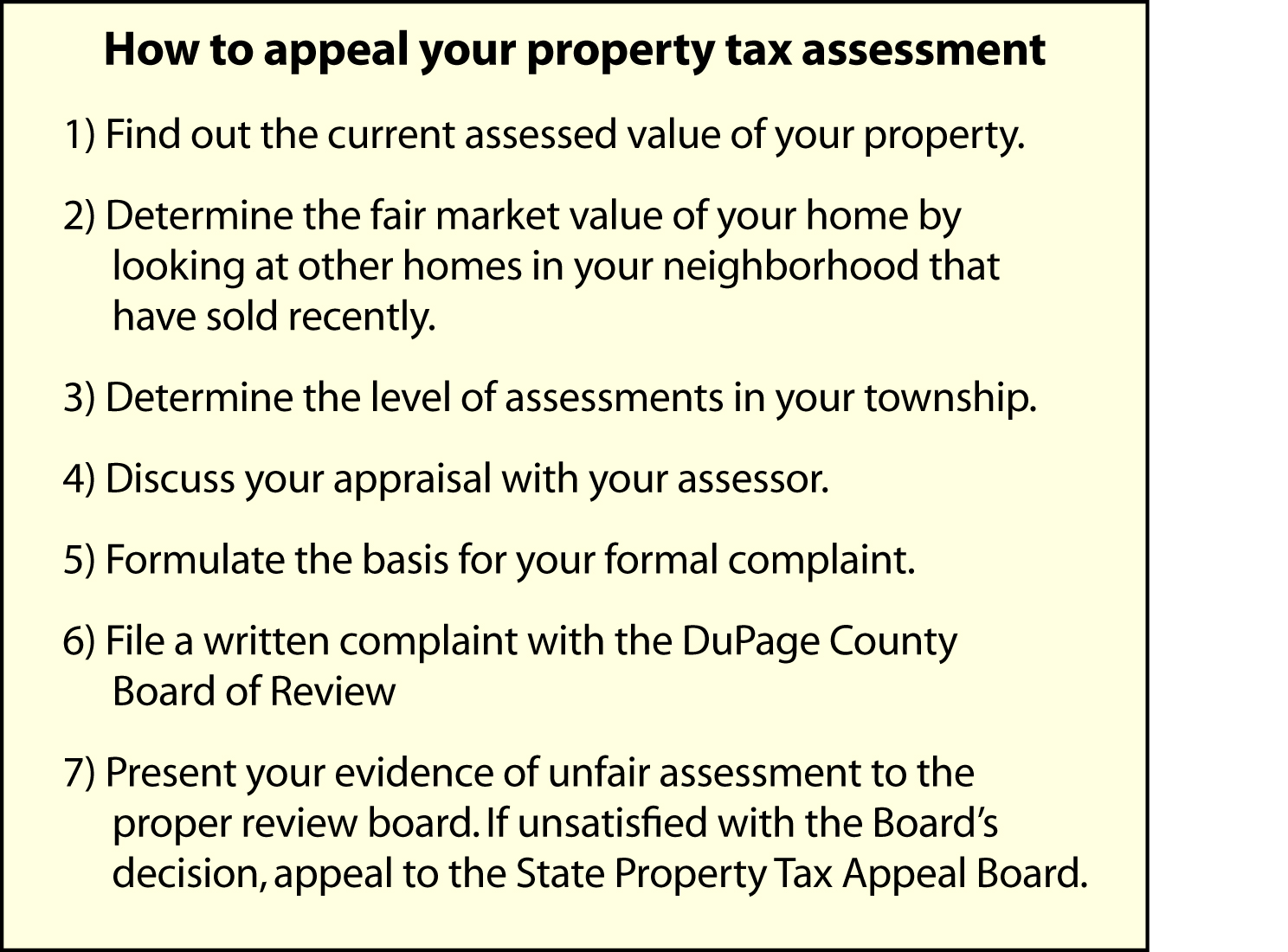

How to appeal taxes. You can submit a property tax appeal letter to your local assessor’s office if you believe that your home value evaluation has gone wrong reasons to appeal property tax assessment once. There’s absolutely nothing fun about it! In most cases, the appeal process begins with you filling out paperwork at the tax assessor’s office.

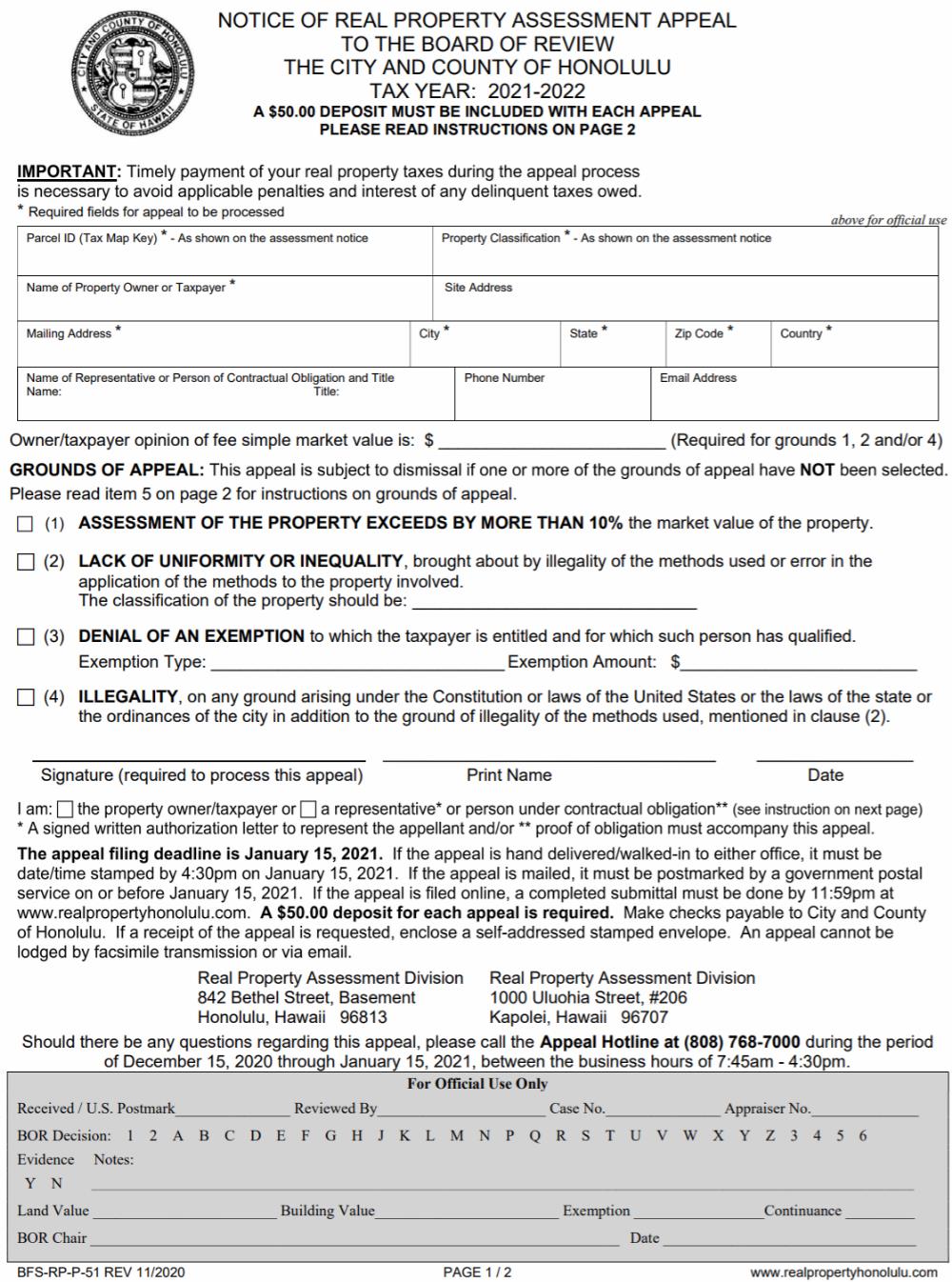

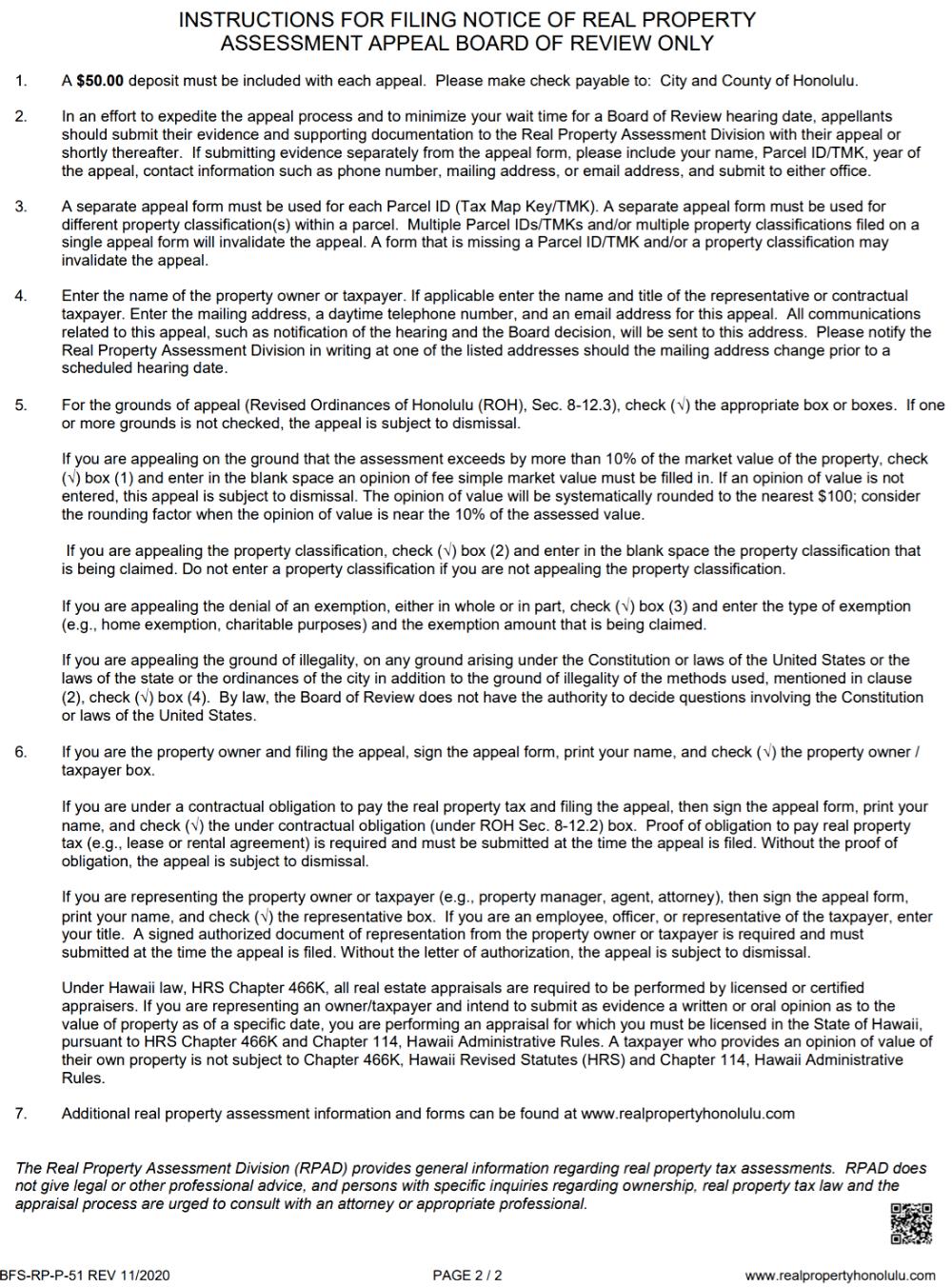

If you wish to request a refund or appeal an assessment or determination, a petition must be filed with the board of appeals. After you determine you meet the criteria for an appeal, ( considering an appeal) you may request an appeal by filing a written protest. You received a letter from the irs explaining your right to appeal the irs’s decision.

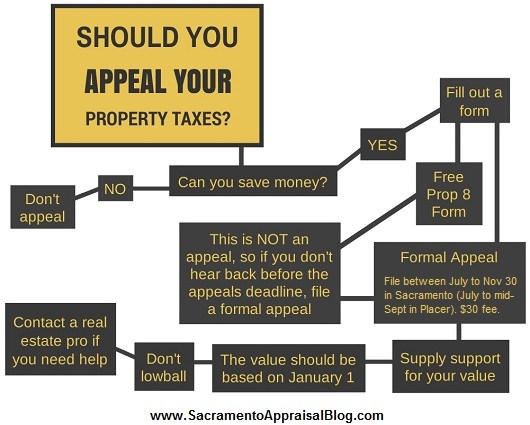

Know how this game works. Discuss the assessment with the assessor to determine how the assessment. Check your property tax assessor’s website.

But many municipalities are now encouraging people to start the appeals process via. Typically, you will simply need to fill out a. Steps in appealing an assessment obtain the property record card with the assessed valuation of the property.

To file online visit eappeals to learn about how property is assessed and file a real property. A look at how to lower your property taxes. Know your municipality’s appeal requirements.

But the property tax system is somewhat labyrinthine and you. During the year of the reappraisal or any year of the reappraisal cycle, a taxpayer may appeal the appraised value of his property. Maybe “game” is the wrong word.

The information in this material is not intended as tax or legal advice. Check to see if your township is open for. Decide if a property tax.

You can file a petition electronically at. The property tax appeal process explained 1. Appeals may be the place for you if all the following apply:

File an appeal and ask for a new assessment. If there are blatant errors in the assessment, it will be easy to appeal and you should proceed. An appeal can only be filed during certain timeframes.

The taxpayer may appeal any. Please consult legal or tax professionals for. Local governments periodically assess all the real estate they tax.